Why this libertarian is voting Romney, with enthusiasm →

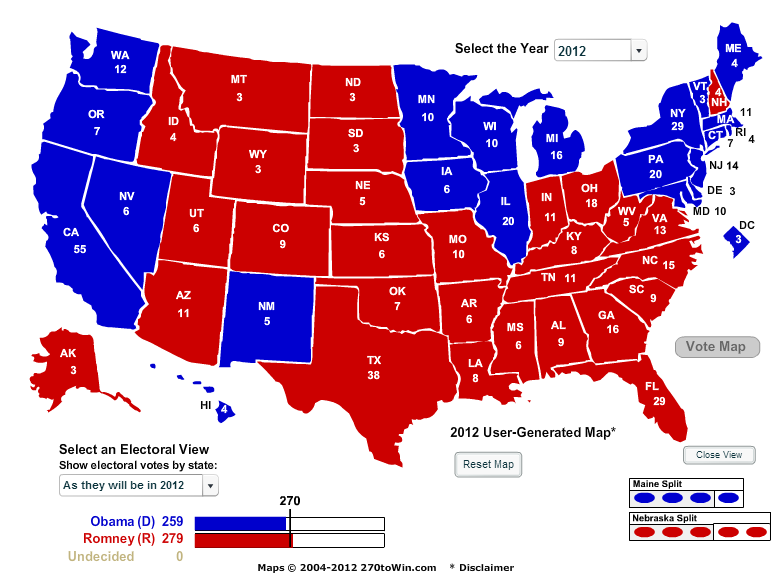

First, it is admittedly tempting for a libertarian voter to fill in the oval for Johnson, the former New Mexico Governor. Johnson is far and away the best candidate the LP has ever put forward, and would make an excellent president. But the bottom line is this: Gary Johnson is not going to be elected president on November 6. Either Mitt Romney or Barack Obama will have that honor and burden. So I don’t have to choose between Romney and Johnson. I’m choosing between Romney and Obama.

Here’s why I like Mitt:

- Obamacare. One reason many libertarians are skeptical of Romney was his introduction of “Romneycare” in Massachusetts. Many people, including the Obama Administration, like to say that this was the genesis of the despised individual mandate. Governor Romney has offered various reasons why Romneycare is different (federalism, substantive differences), which are not convincing to many libertarians.

Fine. But here’s the thing. For most libertarians, this is one of the most important issues in decades. Libertarians worry that Obamacare, beyond being an atrociously designed law even on its own terms and assumptions, will fundamentally alter the relationship between Americans and our government, and cement into place once and for all a European-style social democracy.

Romney has pledged to repeal Obamacare. It is one of his most visible pledges, and therefore – even if one doesn’t trust Romney (I do, although I’m not sure he can get repeal done) – it will be one of the hardest for him to break or ignore. And he has vowed to use Obama’s own weapon – executive branch waivers – to effectively stop implementation of the Act immediately.

So let’s be skeptical. Let’s assume there is only a 10 or 20 percent chance Romney carries through on this promise (I think the odds are much higher, but I’m being cautious and skeptical here). What are the odds of repeal if Obama is re-elected? Zero. Zilch. Nada. None. Nothing. If repeal of Obamacare is truly important – and I think it is – I will not pass up the most (or only) realistic chance to get it done.

2.Taxes. Mitt Romney has expressed a desire for sensible tax reform that most libertarians support – lower rates with a broader base. We’d like to see overall taxes decline, but in the face of massive deficits, with a public unwilling to stand for major cuts in entitlements, that’s probably not a realistic option. But Mitt Romney and his running mate Paul Ryan have promised to try. Barack Obama, on the other hand, has expressed again and again his desire and determination to raise income tax rates, and, at times, even to do so solely for the purpose of redistributing income. And to add insult to injury, Obama’s Orwellian language about “asking” some “to pay a little bit more” grates every time one hears it.

Walter Mondale campaigned on raising taxes and lost. Bill Clinton campaigned on cutting taxes, won, and promptly raised the marginal income tax rates. Libertarians often like to say that there is no difference between the two major parties. But in my lifetime (and I was reading Reason and walking precincts for Ed Clark before many of those young Reason staffers were born) there have been two Presidents who have substantially reduced income tax rates: Ronald Reagan and George W. Bush, both Republicans. Republicans have delivered on income tax rate reductions, and can do so again.

Romney is clearly the superior candidate.

This entry was tagged. Libertarian Mitt Romney President2012