I think that unions are a good solution for a problem that no longer exists. One hundred years ago, many jobs were for factory work or mine work. The skill and quality of the individual employee didn't matter. A person would spend an entire day tending a loom, welding rivets, or doing some other mindless, repetitive job.

If one person quit (or died), someone else could easily step in and take over the job without noticeably slowing production. Workers were largely powerless because management could easily replace individual employees. This left each, individual, employee with almost no leverage. The only way that a threat to stop working meant anything is if every employee made the threat simultaneously. Even that threat was largely meaningless unless an employer could be prevented from just bringing in replacement workers en-masse.

In this kind of environment, a union made a lot of sense. It gave largely indistinguishable workers a way to band together and make management take notice of them. It gave them bargaining power, to fight for safer working conditions and better treatment. It gave them the leverage to end abusive practices like the company store.

During this period, workers were like cogs in a vast, industrial machine. Individually, they were interchangeable, easily replaceable, and mostly ignored. Ultimately, the factory machines (or the mine itself) were far more important or valuable than the individual worker was. But together, they had a voice and could force management to pay attention to them. In this environment, unions were a useful tool.

In a union company, it was important that the job get done. It wasn't really important who did that job. But we no longer live in that environment.

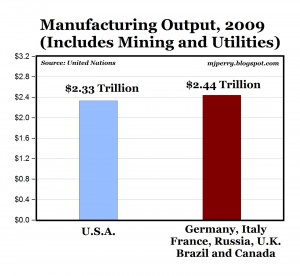

We live in a dynamic economy where factories provide fewer and fewer jobs even as factory output increases. The factory "worker" is changing from interchangeable employees to interchangeable robots. The true factory workers need to have unique, valuable skills. They need to be able to watch the factory floor, constantly looking for problems and creating solutions. The worker is more valuable than the machines he watches over. They can be replaced with a purchase order to the manufacturer. His knowledge and skills can't be replaced so easily.

We live in a dynamic economy where knowledge matters. A lot. A good teacher isn't just a replaceable cog in a machine. He or she knows how to construct a lesson plan, knows how to grade papers fairly, knows the subject matter backwards and forwards, knows how to motivate students, knows how to communicate with parents, and more. A good teacher is valuable and hard to find.

We live in a dynamic economy where the best worker is the one who can learn the most and do more than one task well. We live in a dynamic economy where what you can do today isn't nearly as important as what you'll be able to do tomorrow. We live in a dynamic economy where individual creativity and initiative far outweigh the ability to follow rote orders or do the exact same thing day after day, year after year.

In a modern company, it's still important that the job get done. But it's far more important who does the job. The employee's unique knowledge, skills, and input are crucial to the success of the company. The employee is hired to make decisions, to look at a problem, see a solution, and then implement the solution. The employee is hired to work independently and confidently, using his brain as the ultimate tool. This is the environment we live in now.

Unions are ill suited to this environment. Union collective bargaining agreements are written for last century's economy. Union contracts treat employees as replaceable cogs in a machine.

Take, for example, the contract for Madison Teachers Incorporated. Pages 10-15 of the 2009-2011 contract lay out the pay scale for teachers. The entire section assumes that one teacher with a given set of qualifications and credentials is just as good as another teacher with the same set of qualifications and credentials.

No allowance is made for differences in the amount of time that teachers put into the job each day. No allowance is made for the enthusiasm or creative thinking that each teacher brings to the job. No allowance is made for, well, anything that makes a good teacher a good teacher. As far as the contract is concerned, you could take away Mr. Smith and replace him with Ms. Jones and absolutely nothing would have changed.

Instead of valuing flexibility, creativity, and employee knowledge, a union values employee longevity. The employee that has been around the longest, that has the most invested in the union, that has the most clout in the union is favored over the younger employee. That holds true even when the older employee is contributing little to the organization and the younger employee is contributing much to the organization. It doesn't matter. When the time comes for layoffs, the younger employee goes and the tenured, long-time employee stays. This, of course, does wonders for the work effort and morale of the younger employees.

Unions also restrict the ability of the employer to reward and retain the most valuable employees. Union contracts reward every employee the same, based on classification. When it comes time for raises, everyone in the unit gets the same raise regardless of their individual value to the organization. In any organization there are a few great employees who provide much of the creativity and drive. There are a lot of good employees who do their jobs well. And there are always a few bad employees who either don't do their job well or who can't be relied upon to make good decisions and execute tasks properly.

An organization should have the freedom to reward the top performers appropriately, giving them little reason to leave for greener pastures. And the organization should have the freedom to fire the low performers and seek out new hires who might be able to contribute more. Union contracts forbid this kind of personnel management and leave departments unable to retain their top performers while they're also unable to shed their dead weight.

Worse still, the union contract locks in a specific set of work conditions and job responsibilities. It gives employers very little flexibility to deal with changing conditions and changing needs. Before any change can occur, the employer must first convince the employees that the change is necessary and desirable.

For workers who are used to working a specific way (and have grown comfortable in that), that's a very tough sell. If large changes are needed, it can be practically impossible to convince the employees to change. The employer is stuck with a workforce that won't adapt to new needs and that it can't replace. That's a recipe for stagnation and, eventually, death.

Unions are, quite understandably, opposed to any changes that might lead to the elimination of any jobs. Unions exist to protect workers and to ensure that no jobs are ever destroyed. Unions can (and do!) prevent employers from switching to more efficient processes and more efficient technology.

The union mindset would ensure that every car still came with a buggy whip holder and a buggy whip. Sure, they're useless. But the alternative would mean that buggy whip makers would be unemployed and a union wouldn't be able to allow that. Don't believe me? Then why did railroads pay "firemen" to ride in the cab of diesel locomotives, 50 years after diesel engines replaced coal engines?

No, unions are ill suited to the modern work environment. Where the economy requires flexibility, unions offer rigidity. Where the economy requires creativity, unions offer only cog-like employees. Where the economy values unique skills and contributions, the union values longevity.

An organization full of union employees is an organization that is quickly headed for the trash heap of history.