Health Care Cost Increase Is Projected for New Law

Health Care Cost Increase Is Projected for New Law - NYTimes.com

A government analysis of the new health care law says it will not slow the overall growth of health spending because the expansion of insurance and services to 34 million people will offset cost reductions in Medicare and other programs.

The study, by the chief Medicare actuary, Richard S. Foster, provides a detailed, rigorous analysis of the law.

In signing the measure last month, President Obama said it would "bring down health care costs for families and businesses and governments."

But Mr. Foster said, "Overall national health expenditures under the health reform act would increase by a total of $311 billion," or nine-tenths of 1 percent, compared with the amounts that would otherwise be spent from 2010 to 2019.

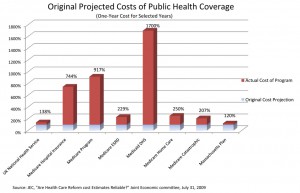

This analysis isn't really a surprise to me. It seems pretty obvious that adding lots and lots to uninsured people to Medicare will increase costs by quite a bit. And, this picture, is actually a best case scenario. It assumes that politicians won't act like politicians.

Mr. Foster says the law will save Medicare more than $500 billion in the coming decade and will postpone exhaustion of the Medicare trust fund by 12 years, so it would run out of money in 2029, rather than 2017. In addition, he said, the reduction in the growth of Medicare will lead to lower premiums and co-payments for Medicare beneficiaries.

But, Mr. Foster said, these savings assume that the law will be carried out as written, and that may be an unrealistic assumption. The cuts, he said, "could become unsustainable" because they may drive some hospitals and nursing homes into the red, "possibly jeopardizing access to care for beneficiaries."

If you believe that politicians are actually going to cut payments to Medicare physicians and hospitals, then you obviously haven't been paying attention to the votes that have been taken in Washington over the last two decades. Congress loves to talk about cutting payments to Medicare. Then, every time the cuts come due, there's a bipartisan rush to postpone the cuts. Government spending is going up. Way up.

This entry was tagged. Healthcare Policy Medicare Obamacare Reform